Research Report 784

J.E. Simonsen and J.M. Lillywhite

College of Agricultural, Consumer and Environmental Sciences, New Mexico State University

Authors: Respectively, Senior Research Specialist and Associate Professor, Department of Agricultural Economics and Agricultural Business, New Mexico State University. (Print friendly PDF)

Introduction

A certification mark is defined by the U.S. Patent and Trademark Office as any word, name, symbol, or device owned by one party and used by another party or parties to certify some aspect of the mark owner's good or service. Certification marks have been used to add value to agricultural commodities in the United States. This marketing strategy conveys additional information about the product that consumers find useful and can result in price premiums over generic commodity prices. Exploring previous research related to the development and use of certification programs in U.S. food and agricultural commodity industries can provide insights into the challenges and opportunities facing other agricultural industries seeking to develop their own certifications. In this publication, we consider past research in U.S. agricultural industries related to certification price premiums, differentiation and certification strategies, and the influence of marketing, product mix, product form or state, certifying agency, and stakeholders on the potential for program viability and success.

Price Premiums Connected with Certification

Researchers have attempted to quantify the value consumers place on a wide variety of claims related to a good's production area, such as a certification of geographical production region. Production area claims can be national, regional, or local in scope.

Differentiation at a National Level

Perhaps the most widely recognized national differentiation program is the Country of Origin Labeling (COOL) program. U.S. consumers' willingness to pay for COOL has been explored previously in a variety of food categories, including meats, fruits, and vegetables. In one study, researchers used a stated preference approach to elicit the premiums respondents would be willing to pay to "guarantee that your beef is Certified U.S. Beef" (Loureiro and Umberger, 2003, p. 295). The data suggest consumers were willing to pay premiums of 38.3% and 58.3% for "U.S. Certified" steaks and hamburger, respectively. In a second study, researchers used a stated preference auction to elicit the value of a "U.S. Guaranteed" steak for Chicago and Denver residents (Umberger et al., 2003). On average, respondents were willing to pay a 19% premium for the "U.S. Guaranteed" steak. Researchers noted, however, that the willingness to pay may vary by product or label used.

Previous research has also explored the value of COOL used with fresh apples and tomatoes. The vast majority of surveyed Georgia, Florida, and Michigan consumers were willing to pay more for apples and tomatoes with COOL (79% and 72%, respectively; Mabiso et al., 2005). This study used an experimental auction with separate auctions for apples and tomatoes, each with four rounds of bidding, to assess consumers' willingness to pay for each product. The use of a "Grown in the U.S." label on apples resulted in a $0.49 per pound premium, while the same label resulted in a $0.48 per pound premium for tomatoes. While Mabiso et al. (2005) suggest that U.S.-grown labels may provide a competitive advantage over imports, U.S. country-of-origin labels are not often seen in the U.S. market (Krissoff et al., 2004). If a product does carry a U.S. country-of-origin label, "the label is not as prominent as other attributes...suggest[ing] that food suppliers see little or no advantage in labeling domestic products as domestic" (Krissoff et al., 2004, p. 6). A number of possible explanations exist for the lack of COOL products in the U.S. Consumers might 1) not care about the origins of their food; 2) prefer the imported product; 3) prefer domestic products, but not enough to cover labeling costs; or 4) demand labels, but markets are not efficiently functioning (i.e., there is a market failure; Krissoff et al., 2004).

Differentiation at a Regional Level

Vidalia onions, Texas Ruby Red grapefruit, and Kona coffee represent examples of regional production certifications in the U.S. food market. Between 1992 and 2000, Vidalia onions commanded $0.02—$0.20/pound retail premiums over other onions (Boyhan and Torrance, 2001, as cited in Carter et al., 2006). Researchers have attributed this premium, in part, to the Vidalia Onion Committee's "authority to coordinate planting decisions, including acreage reductions" (Carter et al., 2006, p. 521).1 Similarly, price premiums are seen for Texas Ruby Red grapefruit over other grapefruits (Major, 2004). Pure (100%) Kona coffee retails for approximately nine times the average retail price for roasted coffee (Teuber, 2010).

Results of a study exploring consumers' willingness to pay for a hypothetical region-of-production-certified blackberry jam found that a "state proud" logo increased consumers' willingness to pay by $0.13 per jar, while "identification as a product of the Appalachian region was worth substantially more — 34 cents per jar" (Batte et al., 2010, p. 9). This suggests that correctly defining the production region preferred by consumers can positively influence the premium received for a region-of-production-certified processed product.

Differentiation at a Local Level

In general, previous research suggests that production area claims also have the potential for success at the state level. It is important to note, however, that these studies explored local consumers' willingness to pay for local products; for example, the preferences of Arizona residents for Arizona produce. Almost all states use a state-grown label to market some of their agricultural production. Researchers found that "a state logo has the potential to be used successfully to differentiate farm-raised catfish and encourage its sale even when an adjoining state is using its own state logo to promote a substitute product" (Schupp and Dellenbarger, 1993, p. 19). Previous research has explored the use of a state-grown label in the context of fresh vegetables. Researchers used a stated preference, discrete choice experiment to elicit preferences for both carrots and spinach. Results suggest consumers were "willing to pay a premium of $0.18 per pound for locally grown spinach marked with the Arizona Grown label over locally grown spinach that was not labeled. This premium was higher than the $0.10 premium that would be paid for state-branded carrots" (Nganje et al., 2011, p. 31).

In another study of the "South Carolina grown" label, researchers used a contingent valuation, stated preference model to explore the premiums South Carolina residents might pay for products with the label. Results suggest that "South Carolinians are willing to pay an average premium of about 27% for state-grown produce and about 23% for state-grown animal products relative to out-of-state grown products" (Carpio and Isengildina-Massa, 2009, p. 422—423). However, a state certification does not necessarily ensure price premiums for labeled production. Although the Florida Department of Citrus has created a "Made with Florida Citrus" certification mark, some Florida orange industry stakeholders "are finding it increasingly difficult to survive" (Perret and Thevenod-Mottet, 2010, p. 14), suggesting that the mark may not be particularly valued by U.S. consumers.

Differentiation and Certification Strategies

The product and production attributes being certified are critical components that must be selected when developing a certification program. Industries have certified numerous attributes in order to differentiate their product. Two primary types of marketing characteristics allow differentiation: 1) "intrinsic, verifiable product-based attributes" and 2) "process-based attributes" (Bond et al., 2008, p. 402). In the case of a packaged red lettuce product, a product-based attribute (health claim) was valued more highly by consumers than a process-based attribute (organic certification; Bond et al., 2008). While Vidalia onions are geographically (region-of-production) branded, the industry has primarily used flavor to set Vidalia onions apart from other sweet onions and onions in general (Cox, 2005, as cited in Carter et al., 2006; Costa et al., 2003).

Previous research in the pork industry in the country of Georgia suggests "consumers treat quality certification and product traceability attributes as substitutes" (Ubilava and Foster, 2009, p. 305). Although both traceability and quality certification increased consumers' willingness to pay for pork, "consumers [were] willing to pay about 48% more for the traceability information compared to the quality certification label" (Ubilava and Foster, 2009, p. 310). Region of origin may "act as a quality cue hinting to other characteristics of the food" (Stefani et al., 2006, p. 53). If U.S. consumers also feel traceability implies quality connotations, a region-of-production certification may have a higher potential for success. Quality may be suggested through two types of cues: intrinsic (physical features of the product itself) and extrinsic (related, non-physical aspects of the product, such as price, brand, or region of origin; Stefani et al., 2006). Previous research suggests certification labels effectively signal quality (Zarkin and Anderson, 1992; Caswell and Mojduszka, 1996).

Influence of Marketing

Both trade (e.g., demos, displays, and giveaway products) and non-trade (radio and television) promotions can have significant positive impacts on the demand for a certified product (van Voorthuizen et al., 2002). In the case of Washington apples, trade-merchandising activities, such as ad buys and print media, provided the largest returns per advertising dollar spent (van Voorthuizen et al., 2002). Conversely, consumers of Vidalia onions "rely on newspaper inserts, in-store displays, and in-store promotions to obtain information on fresh produce" (Costa et al., 2003, p. 131). Three-quarters of potato marketing expenditures were used for "media advertising, nutrition education, and other promotion, intended to increase demand [for] and the value perception of fresh [and processed] potatoes" (Jones and Choi, 1992, p. 194). This suggests the most effective marketing strategies may differ depending on the product being sold.

Industries exploring certifications should also develop a marketing plan to make more effective use of program resources. Industries may consider collaborative marketing efforts, such as partnering with a supermarket chain to promote their product in a weekly newspaper insert (Costa et al., 2003), to leverage promotional funds efficiently. These strategies can provide valuable marketing outlets for a new certified food product.

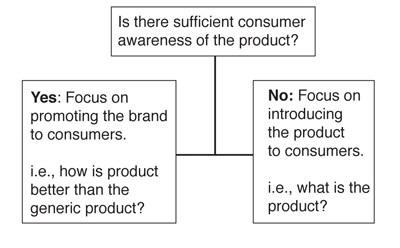

When it comes to purchasing behavior, U.S. consumers should not be considered homogeneous. For example, regional differences in demand are observed for both Washington apples (van Voorthuizen et al., 2002) and Vidalia onions (Costa et al., 2003), suggesting targeted marketing strategies may be appropriate. Certification program administrators must know their likely consumers and market their product accordingly. The marketing strategy used for a new certified product may vary (Figure 1).

Figure 1. Decision tree for marketing a certified product (adapted from Costa et al., 2003).

Because many U.S. food consumers may still be unfamiliar with a regionally produced agricultural commodity, there may need to be an introductory period. "Introducing products to consumers requires resources and time [emphasis added] and is fundamental to a successful marketing strategy" (Costa et al., 2003, p. 125). Consumers may not purchase a product until they have seen multiple advertisements (Lee and Brown, 1992), and advertising must be continuous in order for consumers to remember the product (Zielskem, 1959, as cited in Lee and Brown, 1992). Moreover, consumers may need to be educated about the product in order to make the decision to purchase and consume it (e.g., Frewer et al., 2003). Educated consumers may have the knowledge to evaluate product quality appropriately when presented with a quality-related certification (e.g., Antle, 2001). Once consumers prefer the certified product, this information can be included in marketing materials targeted at wholesalers, distributors, and retailers (Costa et al., 2003) in order to improve the buy-in of these value chain participants.

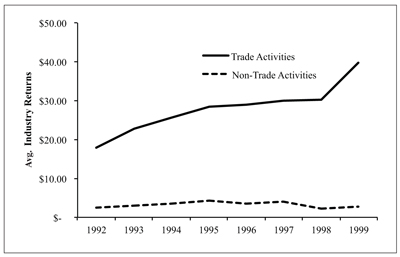

Successful certification programs can require significant marketing expenditures to raise consumers' brand awareness. The Washington Apple Commission has spent hundreds of millions of dollars on marketing and research since its inception (Carter et al., 2006). Between 1996 and 2000, the Vidalia Onion Committee spent almost $440,000 on regional and national advertising, resulting in a $52.68 return per dollar of promotion expenditure (Costa et al., 2003). Commodity-wide advertising expenditures for potatoes averaged $5.7 million between 1987 and 1988 (Jones and Choi, 1992). While marketing expenditure estimates are not available, research suggests that commodity advertising increased U.S. demand for orange juice (Lee and Brown, 1992) and potatoes (Jones and Choi, 1992). The type of marketing influences its impact: research examining Washington apple marketing expenditures identified that trade activities provided much higher returns than non-trade activities (van Voorthuizen et al., 2002; Figure 2).

Figure 2. Simulated average industry returns for promotional efforts in the Washington apple industry, 1992—1999 (adapted from van Voorthuizen et al., 2002).

Unfortunately, the Washington Apple Commission "[has] not been able to maintain coordination over funding" of marketing activities (Carter et al, 2006, p. 522) because growers do not find the Washington Apple logo specific enough for their branding goals. Washington produces many apple cultivars, and each cultivar's growers "bear greater resemblance to the Vidalia onion growers as specialty growers, than do [Washington's] apple growers as a group" (Carter et al., 2006, p. 522). It is possible that some other agricultural industries are also too diverse for an industry-wide certification to be appropriate.

Influence of Product Mix

When marketing a processed food product, the product may contain a percentage of a certified ingredient. Unless requirements are developed by the certifying agency, "the proportion of the premium ingredient appropriate to carry the quality name is subject to interpretation" (Hodgson and Bruhn, 1993, p. 164) by both consumers and supply chain participants. Previous research has examined the variation in consumer perceptions between a 100% Kona coffee and a blended Kona coffee product (at least 10% Kona coffee).2 During focus groups with Hawaiian coffee consumers, researchers identified several consumer expectations regarding product mix (Hodgson and Bruhn, 1993), including that:

- Kona coffee is the primary ingredient in a Kona coffee blended product,

- "The location of origin of the respective coffee beans used in the blend should be listed in an ingredient label" (p. 167),

- The actual amount of Kona coffee used in the blend should be reported on the label, and

- A Kona coffee blended product should contain more than 10% Kona coffee. For example, one consumer responded, "This is deceptive. They are appealing to a name when they don't really have the right because they are using a small amount" (p. 168). A second consumer noted, "I won't pay that much for a 10% blend. With 10% (of pure Kona) coffee, you should only have to pay 10% of the price!" (p. 169).

The development and structure of a certification program can influence which stakeholders benefit, as well as how much. For example, a blended Kona product increases economic returns for Kona blenders, while growers "experience no benefit from the blending...in fact, they experience a loss that is possibly on the order or greater than the gain to the blenders" (Feldman, 2010, p. 8). Industries contemplating a certification program should be aware of the potential for disparate benefits across the value chain.

Previous research has also examined the product mix for organic ingredients relative to the entire ingredient mix. In the case of breakfast cereal, "consumers are willing to pay premium prices for organic foods, even those with less than 100 percent organic ingredients" (Batte et al., 2004, p. 15). It is unknown whether a similar trend exists for other processed food products containing a certified ingredient. These preferences could influence the success of the certification program when the certification is used to differentiate processed products. In some industries, processors mix product from different regions to obtain specific quality attributes (e.g., flavor, color, acidity), such as in the orange juice industry (Hart, 2004). If processors mix certified and uncertified versions of a commodity when creating a product according to a specific recipe, a certification that requires 100% certified product may influence product quality. Thus, processors may derail grower certification efforts.

Influence of Product Form/State

There has been a limited amount of research exploring the influence of product form/state on consumers' willingness to pay for specific attributes. Wirth and Davis (2004) explored southeastern U.S. seafood dealers' shrimp preferences using ratings-based conjoint analysis. Four shrimp attributes were studied: size, state (fresh/frozen), form (whole, shell-on tails, peeled and deveined tails), and price. Product form, defined as the amount of processing the shrimp underwent (e.g., whole, peeled), was the most important attribute of the four studied. Interestingly, "state (fresh or frozen) has no significant effect on the product rating" (Wirth and Davis, 2003, p. 12).

Freshwater prawns were the subject of a similar study in Kentucky, where researchers also explored consumer preferences using ratings-based conjoint analysis. Four attributes were studied: state (fresh/frozen), form (whole/tail), origin (Kentucky-grown/not Kentucky-grown), and price (Dasgupta et al., 2010). Similar to Wirth and Davis (2003), state was not "a crucial determinant in making purchasing decisions for most consumers" (Dasgupta et al., 2010, p. 21). While preferences toward product form were mixed (44% of respondents preferred whole prawns while 56% preferred tails), preferences were not significantly influenced by demographic characteristics (Dasgupta et al., 2010).

The importance of product state (fresh/frozen) has also been explored in the blueberry industry. The blueberry preferences of northeastern and southeastern consumers were examined using a web-based survey. Four blueberry attributes were studied: state (fresh/frozen), production method (organic/conventional), price, and place of origin (local, U.S., or imported). Results suggest "consumers generally prefer fresh blueberries over frozen" (Shi et al., 2011, p. 12).

Product form has also been explored as it relates to convenience for the consumer (e.g., convenience to prepare for vegetables and packaging for fruit). Van der Pol and Ryan (1996) studied consumer preferences toward fruits and vegetables within the context of four attributes: quality, location, convenience, and price. Results suggest consumers prefer loose, unpacked vegetables to either whole or chopped packed vegetables. Similarly, fresh/whole lettuce is preferred over processed/bagged lettuce by restaurant managers in Alabama (Reynolds-Allie and Fields, 2011). To our knowledge, however, previous research has not identified the influence of product form/state on consumers' preferences toward a certification. It is currently unknown whether consumers' willingness to pay for a certification is influenced by the state of the product (e.g., fresh, frozen, canned).

Influence of Certifying Agency

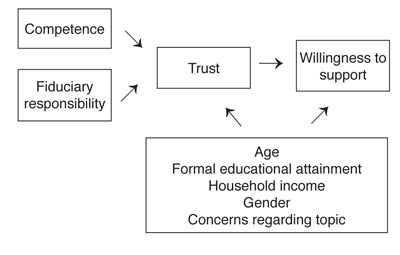

Previous research suggests the certifying agency or certification messenger has a significant effect on the credibility of genetically modified food claims (Roe and Teisl, 2007). This may be because "information credibility is often connected, in part, to perceptions that the messenger is knowledgeable and has no vested interest in the choice" (Roe and Teisl, 2007, p. 57). The certifying agency also incorporates issues of trust (Figure 3) since trust requires that the public perceive the messenger as competent and reasonably responsive, and that they will act with fiduciary responsibility (Sapp et al., 2009). These perceptions may be built over time, which could pose a challenge for a newly created farmer or other non-governmental agency charged with certifying an agricultural commodity.

Figure 3. Influences on trust of U.S. food system messengers (adapted from Sapp et al., 2009).

Influence of Industry Stakeholders

Stakeholders play an important role in the success of a certification program, both during and after its development, as evidenced by the Vidalia onion program. Vidalia onion producers first attempted a state marketing order in 1987, but only 47% of potential voters (growers/packers) participated (voted), and the order was not approved. Interestingly, growers in counties known for Vidalia onion production were less likely to vote, while the size of the grower's onion operation did not influence voting behavior. "For individual voters, the surrounding social and economic conditions were the determining influences" on a grower's decision to both vote and to vote for the state order; unfortunately, many growers were apathetic about the marketing order (Mixon et al., 1990, p. 148). Vidalia producers instead used a federal marketing order to achieve their goals. The federal marketing order stipulates that nonvoters do not influence the outcome; that is, the majority percentage is calculated out of the total number of participating voters rather than the total number of growers in the industry. Thus, the Vidalia federal marketing order was passed in March 1989.

Success Drivers

Previous research suggests three criteria are necessary for geographical-origin-based branding to be successful in the U.S. produce sector (Carter et al., 2006). First, product differentiation is accompanied by or generates a downward sloping demand curve. That is, as prices increase, consumers seek to purchase less of a product (behave rationally). Second, the product's "distinguishing characteristics are maintained and made clear to consumers, usually via promotion" (Carter et al., 2006, p. 525). Broader branding efforts may not be financially supported by producers. Moreover, if the distinguishing characteristics of the certified commodity are too broad or vague, consumers may not respond favorably. Finally, "producers who can control the supply of a branded product and/or restrict entry into their market are more likely to be successful in achieving a price premium" (Carter et al., 2006, p. 525). Supply restrictions (through strategies such as quality inspections and enforcement of fraudulent certification mark use) will affect product prices. Coordination, cooperation, and technical issues may provide roadblocks to restricting supply.

Consistent product quality is also a primary factor influencing the success of other certification programs. Research suggests that to "maintain and extend their leadership in the sweet onion market...Vidalia onions need to set the standard in terms of quality and freshness" (Costa et al., 2003, p. 129). Without these quality standards, a few bad onions may reduce consumer interest in Vidalias, and consumers may substitute other sweet onions. Several years ago, research suggested that some consumers (nearly 10%) perceived the quality of Vidalia onions had recently declined (Costa et al., 2003). This perception of decreased quality could have affected sales and revenue in the short-term, as well as affected long-term viability of the program, if Vidalia's stakeholders did not move to address the issue. Industries exploring certification need to be committed to continued assessment of product quality to build or maintain the certification's value.

Conclusions

Geographical production certifications can be and have been instituted at many production levels. That is, agricultural products can be labeled as products of a nation, region, or local production area. Defining the production region most preferred by consumers can have important consequences for a certification program's success. The level at which a certification program is administered (e.g., national or local) often affects the way in which the program is administered (e.g., federal or state government administration or industry-led administration). Effective administration, regardless of the type or source, is an important component to the success of a certification program. Stakeholders play an important role in the success of a certification program, both during and after its development. To this point, in order to be successful, the program may need to be able to mandate participation. Often, federal marketing orders were instituted for this purpose. A statewide region-of-production certification mark may be too generic for the needs of an industry with multiple product varieties. Certification programs in the U.S. have had various levels of success, both in terms of their effectiveness in commanding price premiums and in terms of garnering support from industry participants. Often region-of-production certifications may imply other types of food product standards, such as traceability, food safety, or quality. To the extent that these attributes are valued by consumers, inclusion of these attributes in a certification program will improve program success.

Footnotes

1 It is important to note that premiums realized in the Vidalia onion industry may be a function of the supply control induced by the marketing order rather than by generation of additional demand for Vidalia onions. (back to top)

2 Hawaii law "mandates that consumers be advised of the amount of Kona Coffee they are purchasing in a Kona Coffee blend" (Hodgson and Bruhn, 1993, p. 168); however, this law does not apply outside the state of Hawaii. (back to top)

Literature Cited

Antle, J.M. 2001. Economic analysis of food safety. In B.L. Gardner and G.C. Rausser (Eds.), Handbook of Agricultural Economics, 1st ed., vol. 1 (1083—1136). Amsterdam: Elsevier.

Batte, M.T., J. Beaverson, N.H. Hooker, and T. Haab. 2004. Customer willingness to pay for multi-ingredient, processed organic food products. Selected paper prepared for presentation at the American Agricultural Economics Association Annual Meeting, Denver, CO, July 1—4, 2004.

Batte, M.T., F.N. Van Buren, W. Hu, T. Woods, and S. Ernst. 2010. Do local production, organic certification, nutritional claims, and product branding pay in consumer food choices? Selected paper prepared for presentation at the Agricultural & Applied Economics Association 2010 AAEA, CAES, & WAEA Joint Annual Meeting, Denver, CO, July 25—27, 2010.

Bond, C.A., D.D. Thilmany, and J.K. Bond. 2008. What to choose? The value of label claims to fresh produce consumers. Journal of Agricultural and Resource Economics, 33, 402—427.

Carpio, C.E., and O. Isengildina-Massa. 2009. Consumer willingness to pay for locally grown products: The case of South Carolina. Agribusiness, 25, 412—426.

Carter, C., B. Krissoff, and A.P. Zwane. 2006. Can country-of-origin labeling succeed as a marketing tool for produce? Lessons from three case studies. Canadian Journal of Agricultural Economics, 54, 513—530.

Caswell, J., and E. Mojduszka. 1996. Using informational labeling to influence the market for quality in food products. American Journal of Agricultural Economics, 78, 1248—1253.

Costa, E.F., K. Wolfe, J.E. Epperson, C.L. Huang, and J.C. McKissick. 2003. Who are the consumers of Vidalia onions? Journal of Food Distribution Research, 34, 123—133.

Dasgupta, S., J. Eaton, and A. Caporelli. 2010. Consumer perceptions of freshwater prawns: Results from a Kentucky farmers' market. Journal of Shellfish Research, 29, 19—23.

Feldman, M. 2010. Economic effects of blending Kona coffee: A preliminary analysis. Decision Resources Report (available from the author).

Frewer, L., J. Scholderer, and N. Lambert. 2003. Consumer acceptance of functional foods: Issues for the future. British Food Journal, 105, 714—731.

Hart, E. 2004. The U.S. orange juice tariff and the "Brazilian invasion" of Florida [Master's thesis]. Medford, MA: Tufts University.

Hodgson, A.S., and C.M. Bruhn. 1993. Consumer attitudes toward the use of geographical product descriptors as a marketing technique for locally grown or manufactured foods. Journal of Food Quality, 16, 163—174.

Jones, E., and Y. Choi. 1992. Advertising of fresh and processed potato products. In H.W. Kinnucan, S.R. Thompson, and H. Chang (Eds.), Commodity Advertising and Promotion (pp. 193—205). Ames: Iowa State University Press.

Krissoff, B., F. Kuchler, K. Nelson, J. Perry, and A. Somwaru. 2004. Country-of-origin labeling: Theory and observation. U.S. Department of Agriculture Economic Research Service Report No. WRS-04-02.

Lee, J., and M.G. Brown. 1992. Commodity versus brand advertising: A case study of the Florida orange juice industry. In H.W. Kinnucan, S.R. Thompson, and H. Chang (Eds.), Commodity Advertising and Promotion (pp. 206—221). Ames: Iowa State University Press.

Loureiro, M.L., and W.J. Umberger. 2003. Estimating consumer willingness to pay for country-of-origin labeling. Journal of Agricultural and Resource Economics, 28, 287—301.

Mabiso, A., J. Sterns, L. House, and A. Wysocki. 2005. Estimating consumers' willingness-to-pay for country-of-origin labels in fresh apples and tomatoes: A double-hurdle probit analysis of American data using factor scores. Selected paper prepared for presentation at the American Agricultural Economics Association Annual Meeting, Providence, RI, July 24—27, 2005.

Major, M. 2004. Ripe for change. Progressive Grocer. February 15, pp. 48—49.

Mixon, B., S.C. Turner, and T.J. Centner. 1990. An empirical analysis of a marketing order referendum for a specialty crop. Western Journal of Agricultural Economics, 15, 144—150.

Nganje, W.E., R.S. Hughner, and N.E. Lee. 2011. State-branded programs and consumer preference for locally grown produce. Agricultural and Resource Economics Review, 40, 20—32.

Perret, A.O., and E. Thevenod-Mottet. 2010. The Florida oranges local agro-food system — Geographical indication or commodity? [Online]. Retrieved June 24, 2014, from http://ageconsearch.umn.edu/bitstream/95215/2/paper%20completo%20120.pdf

Reynolds-Allie, K., and D. Fields. 2011. Alabama restaurant preferences and willingness to pay for local food: A choice based approach. Selected paper prepared for presentation at the Southern Agricultural Economics Association Annual Meeting, Corpus Christi, TX, February 5—8, 2011.

Roe, B., and M.F. Teisl. 2007. Genetically modified food labeling: The impacts of message and messenger on consumer perceptions of labels and products. Food Policy, 32, 49—66.

Sapp, S.G., C. Arnot, J. Fallon, T. Fleck, D. Soorhotlz, M. Sutton-Vermeulen, and J.J.H. Wilson. 2009. Consumer trust in the U.S. food system: An examination of the recreancy theorem. Rural Sociology, 74, 525—545.

Schupp, A.R., and L.E. Dellenbarger. 1993. The effectiveness of state logos for farm-raised catfish. Journal of Food Distribution Research, 24, 11—22.

Shi, L., Z. Gao, and L.A. House. 2011. Consumer WTP for blueberry attributes: A hierarchical Bayesian approach in the WTP space. Selected paper prepared for presentation at the Agricultural and Applied Economics Association's 2011 AAEA & NAREA Joint Annual Meeting, Pittsburgh, PA, July 24—26, 2011.

Stefani, G., D. Romano, and A. Cavicchi. 2006. Consumer expectations, liking and willingness to pay for specialty foods: Do sensory characteristics tell the whole story? Food Quality & Preference, 17, 53—62.

Teuber, R. 2010. Geographical indications of origin as a tool of product differentiation: The case of coffee. Journal of International Food & Agribusiness Marketing, 22, 277—298.

Van der Pol, M., and M. Ryan. 1996. Using conjoint analysis to establish consumer preferences for fruit and vegetables. British Food Journal, 98, 5—12.

Van Voorthuizen, H., T. Schotzko, and R. Mittelhammer. 2002. Measuring the effects of generic price and non-price promotional activities: The case of Washington apples. Presented at the 2002 AAEA Annual Conference, Long Beach, CA.

Ubilava, D., and K. Foster. 2009. Quality certification vs. product traceability: Consumer preferences for informational attributes of pork in Georgia. Food Policy, 34, 305—310.

Umberger, W.J., D.M. Feuz, C.R. Calkins, and B.M. Sitz. 2003. Country-of-origin labeling of beef products: U.S. consumers' perceptions. Journal of Food Distribution Research, 34, 103—116.

United States Patent and Trademark Office (USPTO). 2003. Geographical indication protection in the United States [Online]. Retrieved August 19, 2013, from http://www.uspto.gov/web/offices/dcom/olia/globalip/pdf/gi_system.pdf

Wirth, F.F., and K.J. Davis. 2003. Shrimp purchasing behavior and preferences of seafood dealers. Selected paper prepared for presentation at the Southern Agricultural Economics Association Annual Meeting, Mobile, AL, February 1—5, 2003.

Zarkin, G.A., and D.W. Anderson. 1992. Consumer and producer responses to nutrition label changes. American Journal of Agricultural Economics, 74, 1202—1207.

Dr. Jay Lillywhite is an Associate Professor in the Agricultural Economics and Agricultural Business Department at New Mexico State University. He earned his Ph.D. in Agricultural Economics from Purdue University. Dr. Lillywhite's research addresses agribusiness marketing challenges and opportunities.

To find more resources for your business, home, or family, visit the College of Agricultural, Consumer and Environmental Sciences on the World Wide Web at aces.nmsu.edu

Contents of publications may be freely reproduced for educational purposes. All other rights reserved. For permission to use publications for other purposes, contact pubs@nmsu.edu or the authors listed on the publication.

New Mexico State University is an equal opportunity/affirmative action employer and educator. NMSU and the U.S. Department of Agriculture cooperating.

July 2014